Insurance is mandatory for a motorcycle driven in Singapore. Various insurance providers in Singapore offer different types of insurances with their own flavours. Some offer them with extra coverage included whereas others may offer it as an extra optional cover. If you are new to the world of motorcycle insurance or would like to refresh on motorbike insurance in Singapore, we’ll explain all the basics of motorcycle insurance here.

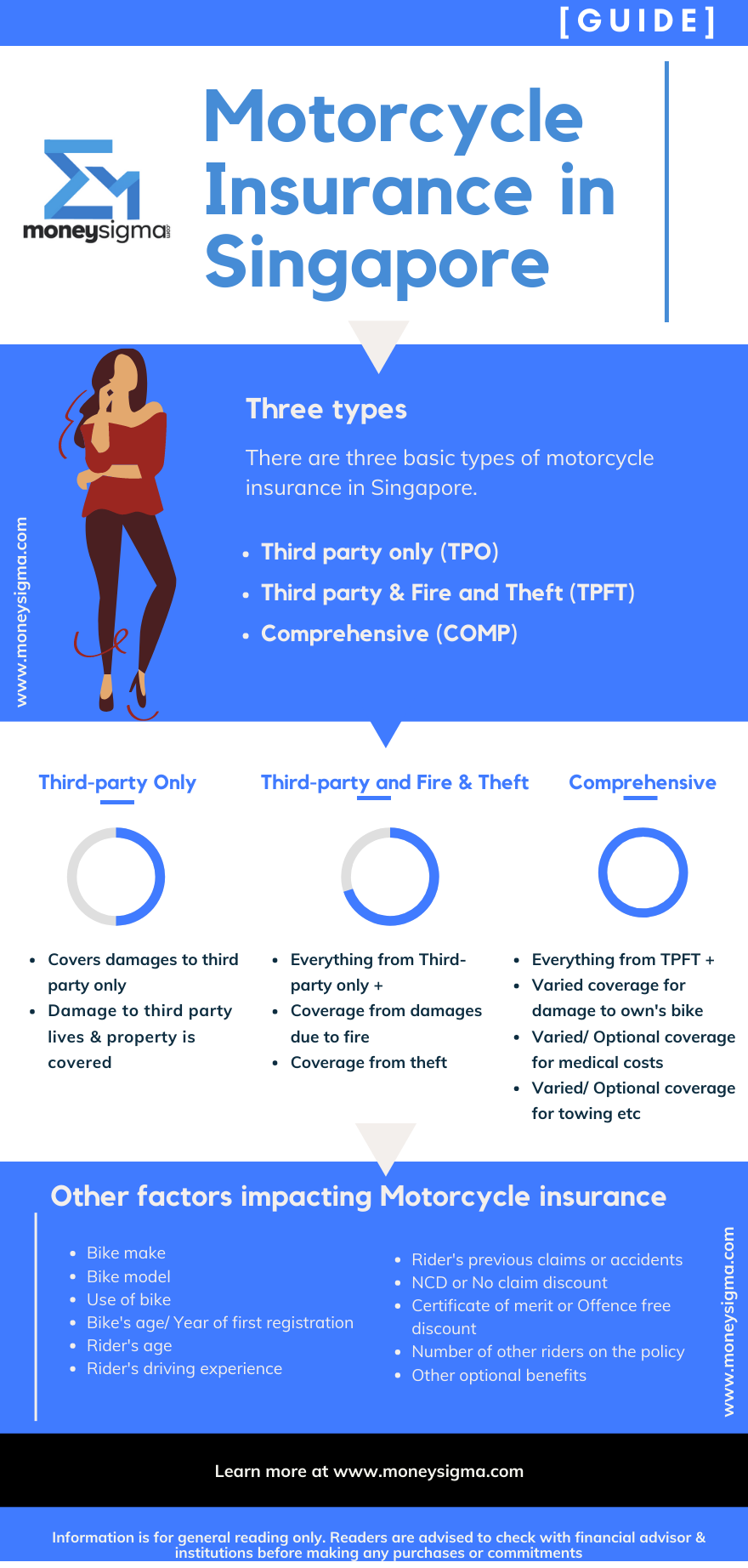

Around the world, the basic types of motorcycle insurance boil down to three different types. Some types have the bare necessity covers while others offer more protection.

Three main types of motorcycle insurance in Singapore

In Singapore, the three main types of motorcycle insurance are –

- Third-party only

- Third-party and Fire & Theft

- Comprehensive

The third party only is the least insurance you should have as mandated by the government.

What is Third party only (TPO) motorcycle insurance?

Third party only or TPO is the bare minimum insurance offered. As the name suggests, this insurance will only cover the third party.

Elaborating it ahead, say if you (the first party) get into an accident, the insurer (the second party) will cover costs involved or damages that you are liable to pay to the other third party you met an accident with.

Since covering the third party for damages or even death in some case is important, the government mandates us to at least have third party insurance.

Third-party only insurance will however not cover any costs or damages to you. So say, if your motorcycle needs repairs due to accidents- the cost will have to be borne by you.

Usually, third party only insurance is the cheapest amongst all the other types, of course, based on various factors of the rider as well as the bike.

What is Third-party and Fire & Theft (TPFT) motorcycle insurance?

Third-party & Fire and Theft or TPFT motorcycle insurance covers everything that the third party insurance covers, but on top of that it also includes protection to your bike if it is stolen or is damaged as a result of a fire.

Say if someone steals your bike and it is irrecoverable, the insurer must pay the pro rated amount to cover the cost for you to get a new bike. Or say if your bike is damaged due to fire, this cover should payout for repairs of the bike or to replace the bike if needed.

The coverage or payout varies according to various insurers and it is good to read the fine prints of each.

What is Comprehensive motorbike insurance?

Comprehensive is usually the most complete cover where the third party damage, damage due to fire or theft as well as other damages to your own vehicle is covered. Comprehensive as the name suggests is “comprehensive” in coverage.

Comprehensive motorcycle insurance type may include covers say for damages to your bike due to your fault (as defined by the policy clauses) or say for workshop repairs due to an accident or towing service or damages to certain parts of the bike or say damages due to floods etc.

Each insurer in Singapore may have a different range of coverages or the sum insured on these types of motorcycle insurance.

How is motorcycle insurance calculated in Singapore?

Any insurance is underwritten based on various factors that may form a risk. Underwriters in an insurance company consider a range of factors that may lead to a claim and thus price the insurance policy accordingly. For example, if a certain bike’s model has a very large windshield, it is more prone to breakages than a smaller bike that does not have a windshield.

Let us look at the various common factors that help in calculating motorcycle insurance in Singapore. By no means is this list exhaustive, but it does including the common factors. This should give you an idea of how motorcycle insurance is calculated in Singapore.

Common factors for calculating motorcycle insurance

1. Bike’s Make and Model

Your bike’s manufacturer, as well as model, is an important factor to calculate the motorcycle insurance. A make or motorcycle brand that is difficult to repair or replace in Singapore will have higher insurance cost than a bike that is easily available.

Within the bike’s make, various models can be priced differently based on the features they carry. A bike with a fancy engine will be harder to repair than a simpler one and thus the insurer may charge you more for the fancy engine cover.

2. Bike’s age or year of first registration

A bike being a mechanical system is bound to wear and tear- thus an older bike is bound to have more repair costs than a brand new one. Hence the age of your bike or the year the bike was first registered in Singapore is an important factor to consider to price the motorcycle insurance.

3. Bike use

If a bike is used for work purposes or commercial purposes such as food deliveries, it is bound to be used more. A person using his or her bike just for leisure or only for travelling to and fro from work will use his or her bike lesser. The lesser the use of the bike, the lesser are the chances of an accident or damages. Thus your usage of the bike is also an important factor to calculate the price of motorcycle insurance.

Insurers charge different premium or package separate policies for various usage. For example, you might need to look for insurance that covers food delivery usage.

4. Previous accidents or claims and NCD

If the main motorcycle rider on the insurance proposal has claims or previous accidents, they are of interest to the insurer’s underwriter. This factor may explain the riders driving profile. The more the number of accidents or claims, the more is likely to be the quoted price of insurance.

NCD or No Claim discount is also an important factor when calculating motorcycle insurance. The more the discount, the lesser is the quoted price. Learn more about what is NCD or No claim discount. The maximum allowed NCD is about 20% in Singapore, however, some insurers like DirectAsia offers 25% or 30% provided you have held 20% for long. On the other hand, insurers like FWD lets you keep 20% NCD for life, provided you stay with them.

5. Offence free discount or Cert of merit

Good riders are rewarded with a certificate of merit in Singapore. This certificate proves that you are a good road citizen as well as a safe rider. Insurers do use this certificate to calculate the premium. Riders with offence free discount or certificate of merit are charged a discounted premium.

Read more about what is a certificate of merit in Singapore.

6. Driver’s driving experience

The time duration the rider has held the driving license is another factor that is used in calculating motorcycle insurance. Older is the license issue date, you are likely to have more riding experience.

Certain insurers may also deny or charge a higher premium for riders with less than two or one year’s driving experience.

7. Motorcycle rider’s age

The age of the motorcycle rider is another factor used to calculate motorcycle insurance. A young rider is considered as probably someone hot blooded and hence more prone to accidents. The older you are, the lesser is the motorcycle insurance quoted.

Some insurers may also deny covering very young riders. In such cases, it is ideal to look at expensive any-rider or named rider motorcycle insurance.

8. Rider’s gender and/or marital status

Not all insurers may consider this factor while calculating their insurance premiums. However, in certain cases, underwriters may choose to write different prices for male riders vs female rider or even marital status. Riders who are married are presumed to be cautious ones.

9. Number of other riders on the policy

More the number of riders, the higher the risk. Thus adding more riders to the policy will lead to increased premium on the motorcycle insurance policy. Also, certain additional rider profiles, such as young or inexperienced riders will further tweak the calculated premium.

10. Optional Covers

Various insurers may also optionally offer other coverages such as extra medical covers in case of accidents or assistance during breakdowns or unexpected towing. Opting for such covers will further add to the calculation of motorcycle premium.

Now that we know how the types of motorcycle insurance in Singapore and how it is calculated, let us have a look at other terminologies a newbie should be aware of.

What is excess in motorbike insurance

When you make a claim, certain policies require the claimant to fork out an excess. Excess is the amount you agree to pay to the insurer whenever a claim is made. The insurer covers the amount towards damages outside the excess.

For example, If you have agreed to an excess of $ 100 on your policy and your claim totals $ 250, you will shoulder the 100, thus the insurer covering $150 of the damages. Excesses are a way to reduce your initial premium and also a way for the insurer to make sure that the total admin cost towards very small claims is taken care of.

Read our exhaustive guide on what is excess and how much excess should you pay.

Always make sure to check the excess you sign up for on your policy, so that you are caught by surprises during your claim.

What are named riders in motorcycle insurance?

Named riders are the additional riders you list on your policy so that they are covered. Not all motorcycle insurance policy are underwritten the same, and hence some may not cover your bike if it happens to meet with an accident while an unauthorised or unnamed rider is riding it.

Some insurers require you to provide the details of the other riders that may ride your bike. This term is usually referred to as named riders in the motorcycle insurance world.

If naming riders is not feasible, one could consider any riders motorcycle insurance, which however might be expensive.

What other coverages are included in motorcycle insurance

Insurers may offer various additional coverages on top of the standard TPO, TPFT or Comprehensive covers of motorcycle insurance. A few of the extra coverages common in Singapore are:

- NCDP or NCD Protection: This cover allows you to protect your NCD.NCD is reduced when you make a claim. With NCD Protection cover, one can keep the NCD at the same percentage, even if he or she has a claim. This may however be only allowed for a certain count of times as mentioned in the policy document.

- Towing: Some covers may offer you extra coverage to pay for towing when your bike breaks down in the middle of the road.

- Extra medical protection: Motorcycle insurers may also offer extra cover or an increased level of protection for any of your medical expenses that arise due to an accident involving the insured motorcycle.

- Workshop choice: Certain insurers would prefer you to repair your bikes on claims only at authorised workshops as they have tie-up with them. However- insurers may also allow you to choose your own workshop, for an extra fee on your insurance premium.

If you do feel the necessity to have these extra coverages, it is a good idea to opt for them while purchasing the motorcycle insurance policy.

Which type of motorcycle insurance should you buy?

Now that we know the various types of motorcycle insurances, common terminologies and the extra covers, how do we go about deciding which type of insurance should I buy?

There are various factors that make us choose one type of insurance over the other. However, there are trends. For example, older or cheaper bike owners tend to get only third party insurance as they can handle the damages to their own bike from their own pocket. On the other hand, expensive bike owners may choose to stick with comprehensive plans.

When should you buy third party only motor cycle insurance?

If your bike is very old or cheap to repair and replace, you may want to only cover yourself from third parties’ claim.

Also, certain insurers may not offer comprehensive cover for bikes that are older than 10 to 15 years.

In such cases, one may choose Third-party only motorcycle insurance.

When should you buy third party and fire & theft motor cycle insurance?

If you are ok to risk the amount required to repair damages to your own bike, but only need covers in case of the third party as well as fire and theft, it is a good idea to choose TPFT or Third-party and fire & theft motorcycle insurance.

Please also check with the insurer if overseas theft, e.g., such as theft in Malaysia is covered under this clause.

TPFT motorcycle insurance is good for folks looking for the median insurance but does not need a comprehensive list of coverages.

When should you buy comprehensive motor cycle insurance?

Comprehensive motorcycle insurance covers most of the scenarios. If you own an expensive bike, and it would be very expensive to repair your own bike, we recommend opting for comprehensive motorcycle insurance.

Comprehensive motorcycle insurance is also recommended if you are someone who needs all possible protection for your lovely bike.

In certain cases, if your bike is on a bank loan, the bank may mandate a comprehensive insurance policy. In that case, you have no choice but to choose the exhaustively covered motorbike insurance.

Motorcycle insurance providers in Singapore

There are various motorbike insurance providers in Singapore and below are few recommended insurers.

- NTUC Income

- DirectAsia Insurance

- FWD Insurance

- Budgetdirect Insurance

- Etiqa Insurance

- Sompo Insurance

If you in the market for motorcycle insurance, do read our guide on ways to save on insurance premium.