When it comes to Credit card bills, many of us will agree to fear the high credit card interest it carries. Most of us would like to clear our credit card bills and maintain a healthy credit rating. It is a healthy financial practice to pay your credit card bills on time. Here at MoneySigma, we’ll help you understand credit cards, how to pay credit card bills, the credit card payments for various banks in Singapore as well as what should you do if you can’t pay credit card bills on time. Some of us would also need tips to save on credit card interest, manage credit card debt and eventually lead a healthy financial life.

How to pay credit card bill: Various ways

With the far reach of technology, credit card bills can be easily paid online. We’ll look at various ways as well as know other methods to pay credit card bills in case online means are not feasible.

How to pay credit card bills online

Paying credit card bills online with Internet banking: If you have a bank account enabled with Internet banking, you can find an option to pay your credit card bills on the internet banking website. If your credit card belongs to the same bank as your internet banking account, you may need to choose to pay the same bank credit card bill. Banks also allow you to pay other bank credit card bills using Internet Banking.

Paying credit card bill online using Banks Mobile App: Almost most high-end banks have mobile apps with fully loaded features. When you log into your bank’s mobile app, you may find an option to pay a credit card bill there. The amount will be deducted from your bank account’s balance.

How to pay credit card bills automatically from your bank

Banks or Credit card companies allow you to sign up to allow them to automatically debit the credit card bill from your bank accounts.

How to pay credit card bills using GIRO

GIRO is a debit mechanism available in Singapore, where a contract can be signed between the consumer and the billing organisation, where a third party, such as bank forms the intermediaries. This allows the Bank to secure and debit your credit card bills and pay it to the billing organisation on a regular repeating basis.

To pay your credit card bills using GIRO, talk to your bank or log in to internet banking and download and fill the GIRO form. Once authorised, the bank will automatically deduct your account and pay the credit card bills for you.

Visiting the bank branch to pay credit card bills

If online means do not work, or in an unforeseen emergency, you can visit the bank branch in person and pay the credit card bill using your bank account balance or cash or cheque.

Using mailed cheques to pay credit card bills

Some banks also allow you to mail your cheques to pay credit card bills. The cheque usually is sent to the mailing address listed on your credit card statement. Check with your credit card issuer on the exact proceedings.

Can you pay credit card bill with another credit card

Typically paying direct monthly credit card bills using other credit cards is not allowed. A balance transfer to another credit card is an option.

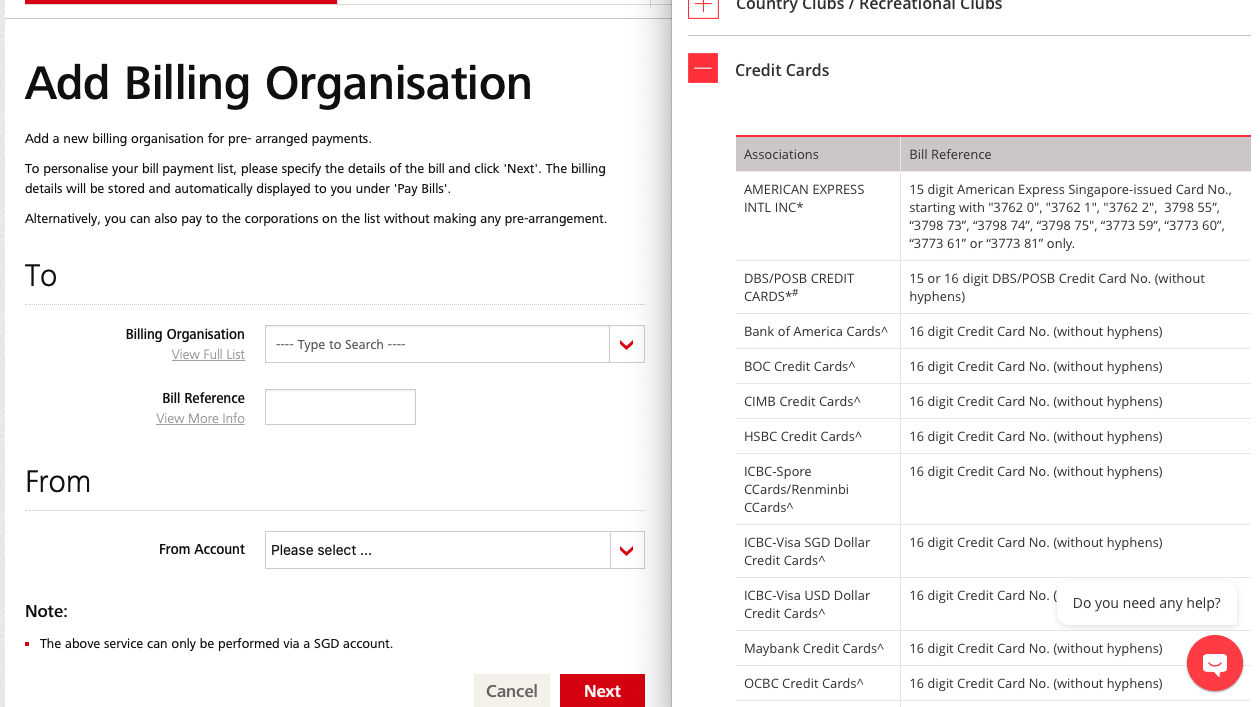

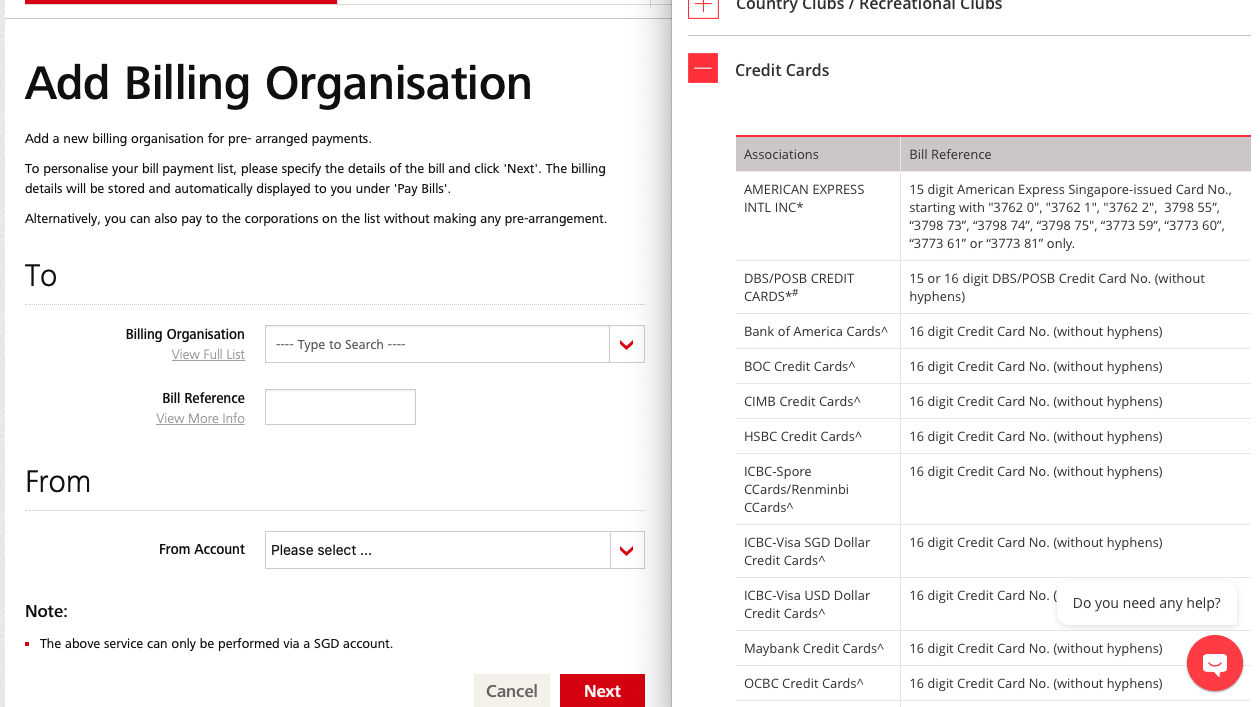

However, in Singapore, banks allow to pay credit card bills using other credit cards.

For example, with DBS/ POSB credit cards, you’ll have to select Pay other credit cards. You’ll need to add another credit card as the billing organisation using your internet banking.

However, since customers can fool around with or abuse credit card points by just paying other credit card’s bill and vice versa, no points or awards are usually offered for a transaction involving other credit cards bills.

Another method to pay credit card bills using another is cash advance. Although this is not recommended, customers can withdraw cash using one credit card and pay the bill of another. But this is an expensive way- as cash withdrawals charges high fees and interests. We do not suggest this option.

How much minimum credit card bill should I pay every month

The minimum credit card bill payment is the minimum you are required to pay to avoid late payment penalties. The total amount is the amount you owe to the bank. Although you can pay the minimum amount, holding on to the rest of the balance may prove costly.

Credit card payments are calculated as the base amount you owe plus any interest you have to pay. This interest is calculated on the base amount. However, if you just pay the minimum amount in this cycle, the interest calculated on the pending amount from the previous cycle is compounded in the next cycle. Thus by delaying the base amount you owe, you end up paying extra fees in the form of compound interest.

In Singapore, the minimum amount to be paid on credit card varies from banks to banks. It is usually 3% of the outstanding amount or S$50, whichever is the highest amongst the two.

Below are the minimum amounts charged by popular banks in Singapore at the time of penning down this article.

| Credit Card Company | Minimum amount charged (The higher amongst both) |

|---|---|

| DBS/ POSB Credit Cards | S$50 or 2.5% to 3% of balance |

| Standard Chartered Credit cards | S$50 or 1% of balance |

| Citibank Credit cards | S$50 or 1% of balance |

| AMEX (American Express) Credit cards | S$50 or 3% of balance |

| OCBC Credit cards | S$50 or 3% of balance |

| UOB Credit cards | S$50 or 3% of balance |

| HSBC Credit cards | S$50 or 3% of balance |

| Maybank Credit cards | S$20 or 3% of balance |

| CIMB Credit cards | S$50 or 3% of balance |

How to not forget paying credit card bill on time

As most of us know, credit card defaulting attracts higher interest rates. Yet, many of us sometimes totally forget to pay our credit card bills on time.

If you are financially crunched, firstly we would like to get you out of this cycle. You might want to get started on budgeting and learning to save money. While that is happening, consider the below options.

- Change your payment date to match your income

- Change your payment frequency to weekly, fortnightly, or monthly to suit your income cycle

If you are just of the forgetful kind, you might want to consider the below options:

- Automating payments using GIRO

- Set online reminders using the credit cards app. (e.g., DBS’s Lifestyle app)

- Set reminders on your mobile phone’s Calendar

What happens if I fail to pay the minimum amount of credit card bill

When you fail to pay the minimum amount of your credit card bill, a late payment fee is charged. You owe the credit card company the outstanding amount, the late payment fee as well as any interest that may be charged.

Late payments also impact negatively on your credit card records, which may lead to a problem with any future approval of loans or other credit cards.

If you further delay payments, the interest is compounded and leads to more dues.

Do you have problems saving money? Do read about our article on tips to save money in Singapore and our budgeting calculator.

How to reduce the interest charged on unpaid credit card debt

There are two approaches to reduce or manage your unpaid credit card debt.

1. Balance Transfer to other credit cards

A balance transfer is when you move your credit card to another provider along with your pending payments. A new credit card provider may offer a 0% introductory deal for you to switch. In such cases, you end up saving on the interest that would have compounded had you stayed with your original credit card provider. This gives you a breathing time to pay off your pending debts.

Balance transfers can be refused and may also involve service charges. We would suggest to calculate the total savings or charges you might incur by going through this process.

2. Switch to a low-interest rate credit card.

If you always hold on to your credit card payments or can’t pay all the amount for every bill, you could consider a low ongoing interest rate credit card. Compare the interest rates provided by credit card companies and then make a switch.

How to save on Credit card annual fees

Most credit card companies are willing to waive off their annual fees if you pay your bills on time.

To waive off the annual fees, you can either fill-up the form online or call their customer service team.

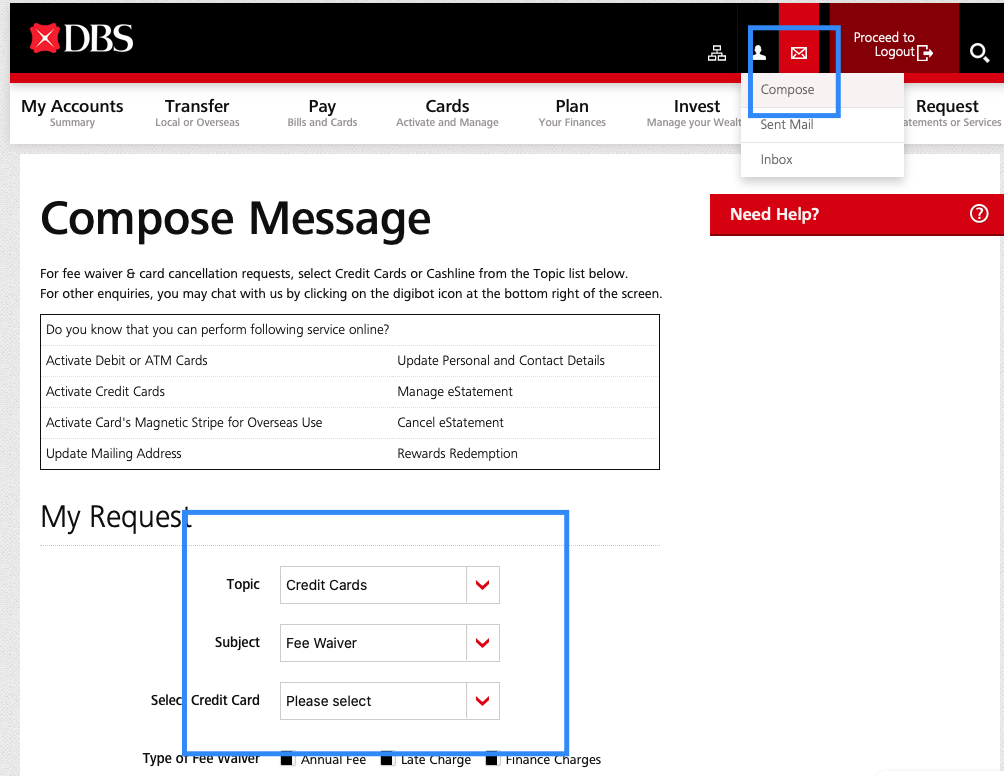

Example for DBS Credit cards, you need to fill the below form online.

How to pay DBS/ POSB Credit card bill in Singapore

DBS or POSB Credit card bills can be paid using the below-listed methods.

- Using digiBank Online or Internet Banking: Login to internet banking and pay the credit card bill online.

- Using DBS/ POSB Mobile app

- Using the DBS Lifestyle app which summarises your credit cards and also list credit card offers.

- From other bank accounts using FAST transfer to DBS Credit card

- SMS Banking: If you have enabled SMS banking on your DBS Account, you can pay bills using an SMS

- Credit card bill payment using ATM: By using an ATM kiosk, you can pay the DBS credit card bill.

- AXS Station: Is another popular method to pay bills in Singapore

- GIRO: You can set up GIRO to pay your credit card bills

DBS Credit card Hotline

The contact number for DBS Lost card and fraud reporting are: 1800 339 6963 (Toll-free) and (65) 6339 6963 from overseas

POSB Credit card Hotline

The contact number for POSB Lost card and fraud reporting is the same as DBS: 1800 339 6963 (Toll-free) and (65) 6339 6963 from overseas

How to pay CitiBank Credit card bill in Singapore

Citibank credit card bills can be paid in the below ways.

- Using FAST transfer from other bank accounts

- Using Citibank’s Online Banking and transferring funds from your Citibank account

- SMS Payment: If you have enabled SMS banking for your Citibank account

- CitiMobile: Using Citibank’s mobile app.

- AXS Payment

Citibank card Hotline

Citibank’s Singapore CitiPhone contact number is (65) 6225 5225

How to pay Standard Chartered credit card bill in Singapore

Standard chartered’s credit card bills can be paid using the below methods as per instruction on their website.

- Using Standard Chartered Online Banking

- Using Standard chartered Mobile Banking or Mobile App

- Using FAST transfer from other bank accounts.

Standard Chartered’s Hotline

Standard Chartered Singapore’s hotline number for Personal banking is (+65) 6747 7000

How to pay OCBC Credit card bill in Singapore

OCBC also allows the below methods to pay credit card bills.

- Using OCBC Internet Banking

- Using the OCBC Mobile app

- Using GIRO

- FAST transfers from other bank accounts.

OCBC Hotline

OCBC Personal banking can be reached at 6363 3333 (24-hour), +65 6363 3333 while calling from overseas.

How to pay UOB Credit card bill in Singapore

UOB credit card bills can be paid as below.

- Using UOB (Mighty) Mobile app

- Using UOB Internet Banking

- Using UOB Phone Banking

- Using UOB’s ATM Kiosk

- GIRO Setups

- S.A.M/ AXS MAchines

- Cash

- Cheques

UOB Hotline

UOB Hotline number is 1800 222 2121 (Toll-free)

How to pay HSBC Credit card bill in Singapore

HSBC Credit card bill payments can be done with the below methods.

- HSBC’s Internet banking

- HSBC Mobile app

- HSBC Banks branches

- HSBC ATMs

- HSBC PhoneBanking

- GIRO Setups

- Cheques

- AXS Stations, SAM Kiosks

- Singpost or 7-11 kiosks

HSBC Hotline number

HSBC’s Phone banking hotline number is 1800-227 8888. For Personal banking, the phone number is +65 6472 2669

How to pay American Express or Amex Credit card bill in Singapore

American Express Credit card bills can be paid by bellow means.

- Internet banking of all other banks (e.g., DBS, POSB, OCBC, UOB, etc)

- Interbank GIRO setups

- Using AXS Kiosks

- By Cheques

- AMEX’s Automatic Bill Payment Service

American Express Credit cards hotline

American Express’ contact number is 1800 299 1997

How to pay Maybank credit card bill in Singapore

Maybank credit card bill payments can be done with the below methods.

- Maybanks’ Online Banking

- Maybank’s Mobile App

- Maybank ATM

- Maybank Cash Deposit machine

- Maybank Branches

- Interbank GIRO

- Using Cheques issued to Maybank

- AXS / Singpost SAM Kiosk

Maybank Singapore hotline

The contact details for Maybank Singapore Personal banking is 1800-777 0022 and +65 6777 0022 while calling from overseas.

More about credit cards

This might be of interest if you are looking to manage your spendings. Did you know about using pre paid or virtual credit cards could help you pre-allocate funds on a card and use them as credit cards? Prepaid cards also give you the security of not worrying about the credit card numbers as they can be changed easily.