Credit cards in Singapore are offered with various reward categories and offer as well as of different types. What are the various types of credit cards in Singapore and how many different kinds of credit card rewards exists in Singapore. We’ll have a deep understanding of the various types of credit cards available in the market.

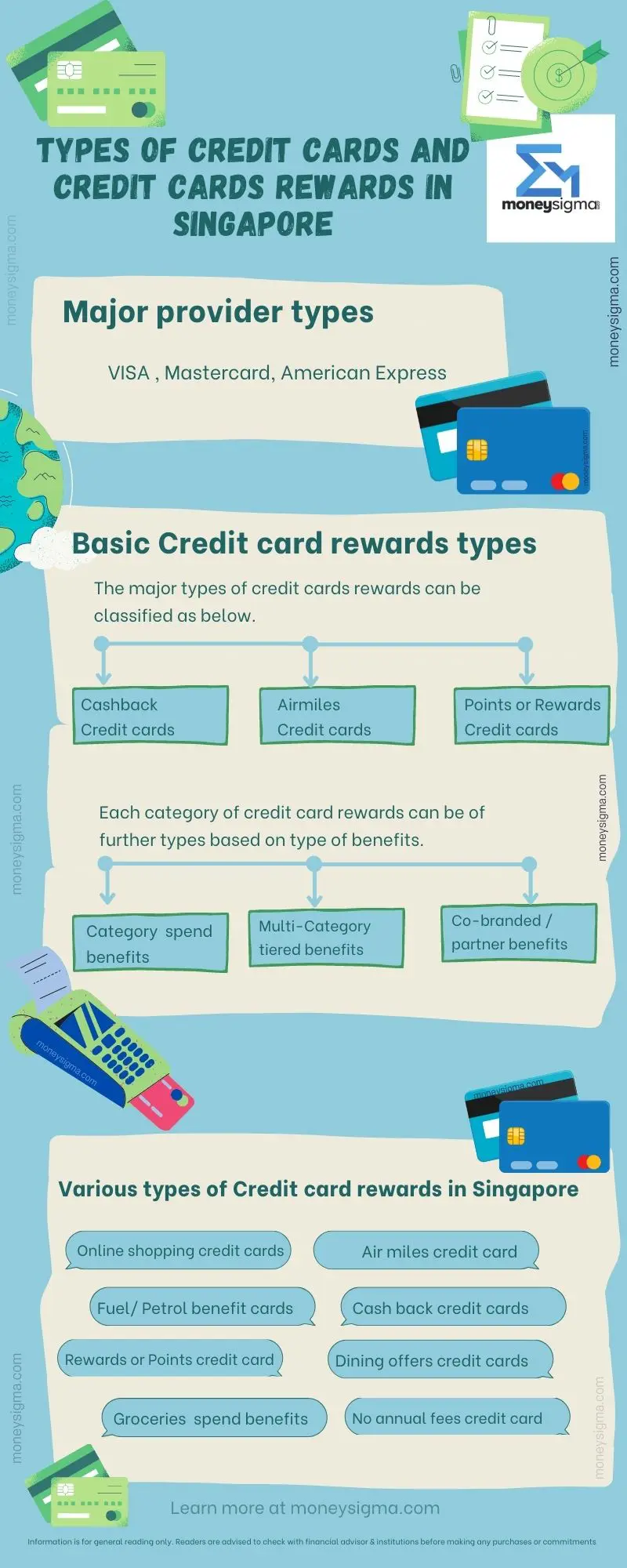

Let’s start with the basics of types of credit card protocols in Singapore

Basic types of credit cards in Singapore

Most credit cards in Singapore follow either of the below-listed protocols. These types of credit cards are popular and widely accepted globally.

The basic types of credit cards in Singapore are

- VISA

- MasterCard

- AMEX

- Diners Club

VISA and MasterCard are payment processing networks and do not issue their cards directly to the public. Financial institutions or banks may offer credit cards that are either VISA or MasterCard. AMEX and Diners Club cards are offered by the respective institutions.

There are not many major differences between these cards as far as most consumers are concerned, but it boils down to the various benefits and credit card rewards each credit card company in Singapore offer. Let us have a look at the types of credit card rewards in Singapore.

Basic types of credit card rewards in Singapore

Credit card rewards are penned down by the issuing banks or financial institutions. The type of credit card i.e, VISA or Mastercard for example, may have a say in drafting the terms of use. However, each financial institutions comes up with various rewards or points and partnerships with other institutions to offer its end users more discounts.

All credit card rewards in Singapore can generally be classified into the below basic categories.

- Cashback credit cards

- Category cash backs

- Multi category tiered cash backs

- Flat percentage cashback cards

- Points based rewards credit cards

- Air miles credit cards

- Branded with partners credit cards

- Prepaid credit cards

Let’s look at each of these credit card rewards types in details.

What are cashback credit cards?

Cashback credit cards are cards that offer you a certain percentage of the spent amount back to the credit. The amount is accumulated and it can be redeemed to offset your next purchase or credit card bill.

For example, if a card offers 5% cashback on all your monthly spending. If your credit card bill amounts to S$1000 for a particular month, you get S$50 back to offset the next bill.

Certain credit card companies may have an additional clause of minimum spend, only after which one is entitled to cash backs. For example, if your card required you to spend S$600 by end of the billing date, but you hit S$599 of sales, you might not be eligible for the cashback.

Few other cards may have no minimum spend requirements for cash backs. These cards are also known as ‘no minimum spend’ credit cards.

Some credit cards also offer sign up cashback which should not be confused for ongoing cash backs. Sign off cash back are a one-time cashback offered if you sign up for the credit card.

Now, cash back cards can be further classified into types based on the types of cashback rewards offered.

Types of cashback credit card rewards in Singapore

Not all cashback credit cards are the same in Singapore. Some credit card companies offer cash back on all spending, whereas others may offer cashback only on certain categories. Within these categories, the cash back percentage or amount might be further different for each category.

Category cash backs

Category cash back credit cards are cards that offer cash backs only on a category of spend.

For example, a credit card that offers 5% cashback on all grocery spends. In such case any spends towards other types of spends, for example, online shopping or fuel etc will not count towards cashback calculations.

If you are someone who foresees most or the majority of your spending belonging to a certain category, then it is a good idea to select these types of credit card rewards.

Multi category tiered cash backs

Multi category or tiered cash back credit cards are cards that offer cash back rewards in various categories, however, they are different for each. For example, a credit card that offers 2% cash back on fuel spends and 1% on groceries and 0.5% on online shopping.

Multi category tiered cash backs will have a range of percentages that are usually lower than a single category cash back credit card. These types of credit cards rewards are useful if you plan to use the credit card to spend on various kinds of stuff throughout the billing cycle.

Flat percentage cash back cards

Flat percentage cash back rewards credit card are cards that offer a flat fixed percentage of cash backs on all spending. These credit cards rewards are not tied to any categories such as fuel or online shopping.

Flat percentage cash back rewards credit cards are also known as true or unlimited cash backs. However, as these cards offer rewards on all spends the percentage is usually lower compared to dedicated category cash back credit cards.

What are points based rewards credit cards?

Points or rewards credit cards as the name suggest are the types that offer you points for spends on your credit cards. These points then can usually be redeemed for vouchers, promotions or products.

Various financial institutions may have different types of points system on such credit cards. For example, one company may offer 5 points for every dollar spent whereas others may offer 10 points for every dollar spent.

The number of points per dollar spent may also be further tied with spends in certain categories or may be applicable for all spending. For example, get 5 points per dollar spent on groceries, but 1 point per dollar spent on online shopping etc.

Points based credit card rewards are good if you enjoy vouchers or offers and usually spend on certain categories.

A point-based credit card can be better than cashback cards in scenarios where your rewards value ends up more with the points than with cash back. For example, for S$100 spend on a cashback card with 1% cashback, you may receive S$1 on cashback. But say if you had a point-based card, which offered 5 points for every dollar spent, you might end up with 500 points. Now if these 500 points fetched you reward more than the ‘S$1’ from the cashback case, then the point-based credit cards reward was a better bet. However, you might have to check the points to dollar value on your selected card for this.

What are air miles credit cards?

Air miles credit cards as the name suggests are credit card reward types that help you collect air miles for your dollars spent on the credit card. These air miles can then be exchanged with partnering airlines for upgrading your tickets, or even free airline travel tickets.

Some credit cards also offer never expiring air miles and hence they can be used for your next trip. You won’t be forced to travel just for the sake of using the miles.

Air miles per dollar spent may be different for different categories of spent on certain credit cards. For example, 1.2 miles per S$1 spent on local expenses whereas 10 miles per S$1 spent on online hotel bookings etc.

Airmiles credit cards rewards are great for those who like to travel overseas a lot or in and around Singapore.

What are co-branded credit cards in Singapore?

Co-branded or partnered credit cards in Singapore are the types where the financial institutions tie-up with certain partners to offer more rewards for using the cards on the partner’s services or platforms.

For example, a card offered by a financial institution partnering with an online e-commerce portal. Citi Lazada is one such card, offered by Citibank which offers you more rewards points for spends on Lazada. Another example of a co-branded credit card would be the Citibank SMRT Card.

If you do spend a lot on one of these partnering businesses, it is a good idea to check on the rewards you could get by signing up for such type of credit card.

Other types of credit cards in Singapore

With the changing scenario in the world of credit cards, there are various other types of credit or debit cards introduced.

Cryptocurrency based credit cards are one such new introduction. These cards offer usual credit cards features as well as help you deal with the cryptocurrency world.

Prepaid or virtual credit cards are another types of cards we recommend one should use for online shopping. With these, one can protect their credit card numbers.

Mix and match of types of credit card rewards offered in Singapore

Now that we have learnt the various types of credit cards and credit card rewards, it would be good to know the types offered by banks and financial institutions here in Singapore.

The credit cards available in the Singaporean market are offered with various benefits- but at the end of the day, they fall into one of the categories we mentioned above.

Few common ‘benefits listed’ or ‘branded as a featured’ credit card available in Singapore would be :

- Online Shopping credit cards

- Air miles credit cards

- Overseas spend credit cards

- Petrol/ Fuel discount credit cards

- Cashback credit cards

- Rewards/ Points credit cards

- Dining Credit cards

- Groceries credit cards

- No Annual fees credit cards

- Student credit card

- Corporate or Business credit cards

In most scenarios, not all credit cards provide all the types rewards on a single card. Some cards offer you a good cashback deal whereas others offer you a good air miles deal. We would recommend analysing your lifestyle and then choose those cards that would offer you the most benefits.

Providers of credit cards in Singapore

The below are few commonly popular credit cards providers in Singapore.

- DBS

- POSB

- Citibank

- Standard Chartered

- OCBC

- UOB

- Maybank

- CIMB

- Bank of China

- ICBC

- HSBC

- American Express

- DinnersClub

- Crypto.com

- Revolut

- Youtrip