When you buy car insurance, in most cases – the policyholder is also the main driver listed on the insurance policy. However, chances are you need to allow other drivers to drive the car and not void the policy terms. In such cases, you are required to add named drivers or choose a policy that allows any driver to drive the car.

Let us have a look at what is named drivers car insurance, in which cases you may need to list or add them, limits on named drivers, their profiles- such as age or occupation, and few tips to note on named driver car insurance policy.

What is named driver car insurance policy ?

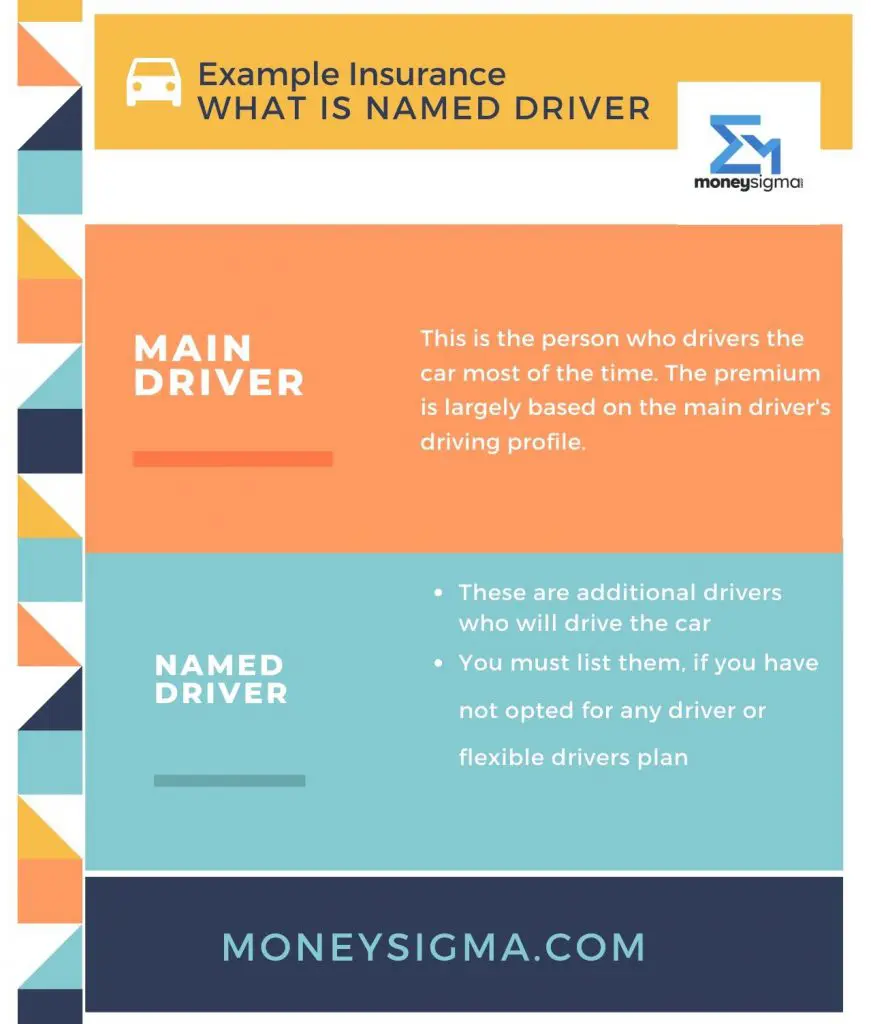

According to most insurers in Singapore or all around the globe for that matter, a main driver is someone who uses the car most of the time. As such, the premium paid is calculated and based on the risk of the main driver profile. For example, if the main driver has a good driving experience, the premium quoted would be lesser. But that also means, the insurer expects the car to be driven by the main driver most of the times.

However, cars may be shared by families or friends and there are high chances you will require someone else to drive the car as well. To include the extra driver’s risk, the insurer expects you to list the drivers who will also drive the car. Such a driver is known as named driver or also as an additional driver.

What is a named driver in car insurance ?

Many insurers also offer policy types, where you can allow an experienced and safe driver (subject to insurer’s definition of safe driver) to drive the car and not be required to name them. Such policies are flexible but may cost you more. For example, DirectAsia offers Flexible plan.

If you are certain of the number of drivers that would use your car, it is a good idea to opt for named drivers car insurance plans and possibly save money compared to flexible plans.

Why do you need named driver car insurance ?

You need a named driver car insurance when you expect other known drivers to drive your insured car. This way, if you happen to claim the insurance while the named driver is driving the car, it will be honored by the insurer.

If you have already purchased a non named driver car insurance and need to allow other known drivers to drive the car, you can always call your insurer to get them listed.

When to use named drivers on car insurance ?

There are various possible scenarios where you would need to use named drivers on a car insurance policy.

Flexible / Any drivers car insurance plan is expensive

Flexible or any drivers car insurance policies allow any safe driver to drive your car. You need not list these drivers on the policy. However, in most cases, the allowed drivers need to have good driving records and experience.

As such, flexible driver plans can be expensive for some drivers profiles. If you are certain of the drivers who will drive the car, you can opt for named driver car insurance when you can save costs.

Flexible /Any drivers conditions cannot be met

Every insurer may define the safe and experienced drivers allowed on a flexible plan differently. It is always good to check the details or conditions of any driver car insurance policy.

For example, some insurers allow drivers aged 30+ and with at least 2 years driving experience as any driver on the flexible plan.

Even though you have a flexible or any driver car insurance, you cannot allow young or inexperienced drivers to drive the car. In such cases, you will need the named driver car insurance plan.

Young inexperienced driver

If you have a young or inexperienced teen who has just gotten his driving license, chances are no insurer would easily offer him or her a policy. In such cases, the young or inexperienced drivers have to be listed as a named driver on the parents or guardians policy plan.

Listing a young or inexperienced driver may increase the premium as well. Some insurers also apply a young and/ or inexperienced driver excess (also known as YIED), in cases where a claim is made by the young driver. Do read about what is excess and the different types of excess applicable on a car or motorcycle insurance policy here.

Spouse or Child the only known drivers

If you are pretty sure that your spouse and or children will drive the car, you may need the named driver car insurance policy as well.

Rejected car insurance as named drivers

Some drivers who have a history of many accidents and or many claims are considered risky by insurers. They may be denied insurance or have their car insurance application rejected.

In such cases, insurers may allow rejected drivers as named drivers on a good driver’s car insurance policy. In cases, either you or someone you know can be listed as a named driver and be insured to drive the car.

What details of named driver are required ?

While listing a named driver on a car insurance policy, the insurer may ask for a varied number of details related to the named driver. These details include anything that would help the insurer determine the risk profile of the driver.

In other words, the insurer wants to know how safe the named driver is and thus calculate the extra premium that should be charged.

Some of the named drivers details asked are:

- Date of Birth

- Years of driving experience

- Number of accidents and or claims history

- Gender and /or Marital Status

- No Claim discount or other applicable discounts (e.g., Certificate of Merit in Singapore)

- Relationship with the Main driver or Policyholder

- Some insurers ask for Occupation as well.

Age of named driver on car insurance

The age of the named drivers is a compelling factor to calculate the premium. Young and inexperienced drivers are considered risky by insurers and hence attract a higher premium.

Usually, drivers aged 25 or less are considered risky and may attract the young driver excess as well. Some insurers, on the other hand, may insure 30+ years old as the main driver. In such cases, younger drivers should be listed as named drivers.

Occupation of named driver on car insurance

Some insurers consider occupation as a rating factor while calculating the insurance premium. For example, a car main or named driver who works in an office will drive his car lesser than those working in sales and thus less prone to accidents. On the other hand, a driver belonging to the entertainment industry may be of higher risk than others.

If insurers deem the occupation of the driver as a necessary rating factor, it must be declared on the named driver car insurance. At the time of writing this article, looks like DirectAsia Insurance in Singapore, does not require us to declare the occupation of the named driver.

Excess for named driver on car insurance

Named drivers who are inexperienced and or belong to the higher risk profile or are insuring a premium car may attract an extra excess while making a claim. This excess is to cover the higher risk that the insurers have to take to insure risky named drivers.

The excess for such drivers vary from insurer to insurer but may range anything from 1000 to 3000$. It is always a good idea to check the excess clause on named drivers.

Tips and Guide for named driver on car insurance

When it comes to adding named drivers on a car insurance policy, it feels like there are various things to take note of or could go wrong. However, there is nothing to fear about, as most insurers are willing to clear the doubts related to named drivers. Here are a few tips from us at Moneysigma, that may help to make an informed decision while buying a named drivers car insurance policy.

- Make sure the named drivers listed, appropriately match the age and driving experience requirement of the insurer.

- Make sure to declare all correct details of the named driver truthfully.

- Check the number of named drivers allowed by the insurer.

- Make sure you understand the excess that may apply to your policy if named driver or listed drivers make a claim.

Named driver insurance FAQs

Does adding named drivers on your policy increase the premium?

Certain insurers offer flexible plans which may include a few drivers already included in the price. However, on named driver plans, adding a driver does increase your premium.

Can someone not listed on my insurance policy drive my car in Singapore?

No, named drivers not listed on the plan cannot drive your car unless your plan covers them as a part of a flexible plan. The flexible plans may cover any unnamed driver as long as they meet the insurer’s defined criteria.

What is fronting in car insurance ?

The policy underwritten by an insurer is based on the main driver’s profile. When one falsely switches the main driver to a named driver and lists an experienced driver as a new main driver, thus attempting to reduce the premium is known as fronting.

Is fronting allowed by insurers in Singapore?

Fronting is wrong and is not allowed by insurers in Singapore. Fronting would void your policy and thus your claims are rejected if fronting is found by the insurer. Fronting is also considered insurance fraud.

Do named drivers on car insurance in Singapore have to be my relatives?

Although most named drivers are usually relatives, however, it is not a requirement for most insurers. Insurers also allow Employers, Employees, Guardians etc to be listed as named drivers.

Can named drivers on car insurance in Singapore be changed?

The named driver’s profile is also used to calculate the premium. As such changing named drivers will yield new premium prices. Insurers may allow you to change the named drivers subject to change in price and if the policy has any outstanding claims.