When it comes to buying car or motorcycle insurance in Singapore, you might have come across the term ‘Cert of Merit’ as well as ‘Offence free discount’. What exactly is Certificate of Merit and how is it useful in insurance in Singapore. Let us found out how you can save more money on your insurance premium with a Certificate of Merit.

When it comes to ways to save on car or motorcycle insurance premium, many buyers are usually well aware with NCD or No Claim Discount. In Singapore, one can claim a further discount using the Certificate of Merit.

Certificate or Merit or Offence free discount

Certificate of Merit, or Cert of Merit or COM is a certificate issued by Traffic Police in Singapore for safe drivers who hold Singapore driving license and have no demerit points issued to them for three or more consecutive years.

Singapore Traffic Police’s Driver Improvement System or DIPS is a system introduced in 1983, which keeps a check on drivers who already have their licenses issued. As such, if you end up gathering 24 demerit points or more in a span of 2 years, it could lead to suspension of the driving license. For repeat offenders, the license is suspended on accumulating 12 or more demerit points within a span of a year.

On the other hand, however, DIPS also looks ahead to promote safe driving. As such, drivers who do not accumulate any demerit points consecutively for a period of three years or more are awarded the certificate of merit.

For drivers who already have a Certificate of merit, it can be revoked or the driver is no more eligible for the cert if he or she ends up getting a demerit point on their driving license.

Certificate of Merit Eligibility

To be eligible for a Certificate of Merit from Singapore’s Traffic Police, the driver must have a valid Singapore driving license and have a demerit free driving records consecutively for the last three years.

As such, new drivers who have just gotten their driving license are not eligible for the certificate.

Is cert of Merit transferrable

Certificate of Merit is tied to a driving license of an individual. As it is based on personal driving skills and driving history, certificate of merit is not transferrable.

While purchasing an insurance policy, one cannot claim a discount based on spouse’s, parents, children’s, or other named driver’s certificate of merit. Insurers underwrite the base policy based on the driving profile of the main driver, hence the main driver’s certificate of merit has to be used.

However, some insurers also enquire about the certificate of merit eligibility of named drivers. If your named driver also has a certificate of merit, a further discount on the named driver insurance premium may be expected.

How to get cert of merit in Singapore

Certificate of Merit is easily available at Singapore Police’s e-services portal here.

Insurers in Singapore also have access to your certificate of merit data through Electronic Driver Data Information and Enquiry System or EDDIES. While purchasing insurance, one should truthfully declare the eligibility.

How to use Cert of merit for insurance premium discount

Most insurers in Singapore ask for eligibility of certificate of Merit during their insurance quotation process.

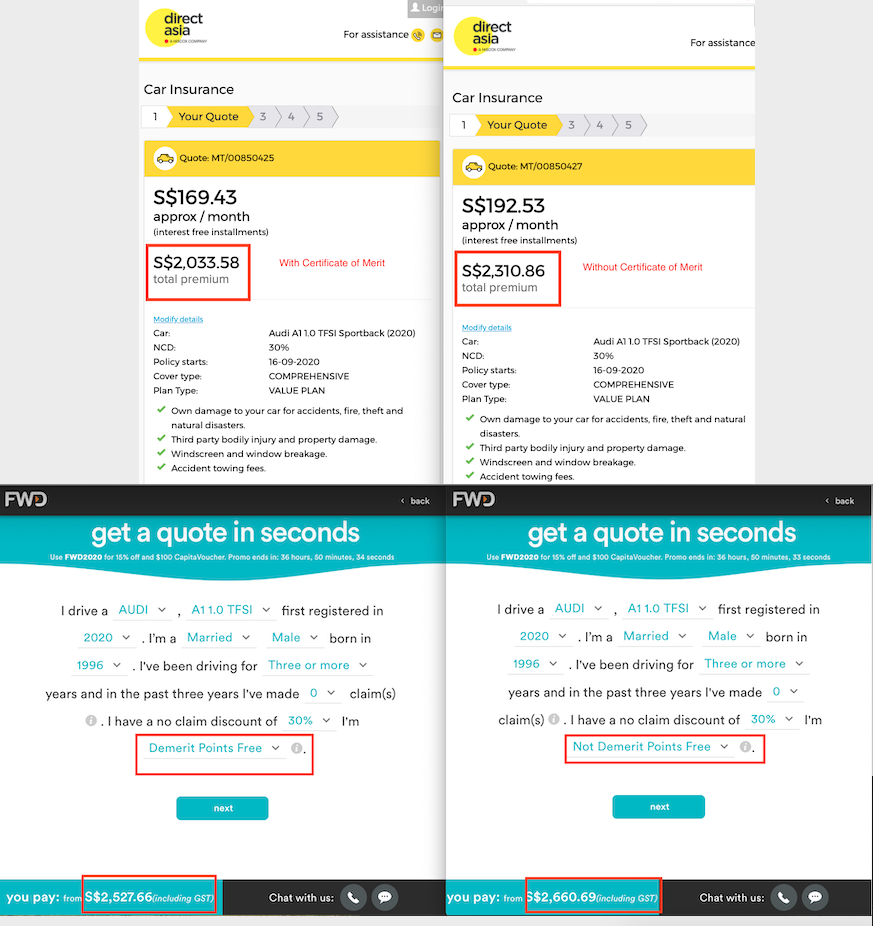

For example, DirectAsia asks the quoter if he or she has a Certificate of Merit from Traffic Police, whereas, on the other hand, FWD asks if you are demerit points free in their quotation journey. Some other insurers also refer to them as ‘Safe driver discount’. When you declare the merit status to the insurer, you may then receive the discount.

As an alternative, you may also call the insurer and declare your certificate of merit status so that they can then process the discount.

How much can I save with cert of merit

Insurers may offer a ranging amount of discount for drivers with a certificate of merit.

In Singapore, provided your no claim discount (NCD) is more than 20%, one can expect close to 5% of discount with a certificate of merit.

At the time of penning this article, an FWD classic car insurance quote cost us S$ 2527.66 with a certificate of merit and about S$ 2,600.69 without cert of merit. On the other hand, DirectAsia car insurance quoted us S$2,033.58 with a certificate of merit and S$2,310.86 without a certificate of merit.

Other terms for Cert of Merit

There are various other names by which agents or insurers refer to Certificate of Merit. Below are a few commonly used terms that you might hear of.

- Certificate of Merit

- Cert of Merit

- Demerit Points Free Discount

- Traffic Police Discount Certificate

- Safe driver discount.

Now that we know the importance of Cert of Merit, do let us know if you have used it and how much discount did you get? As always, safe driving friends!